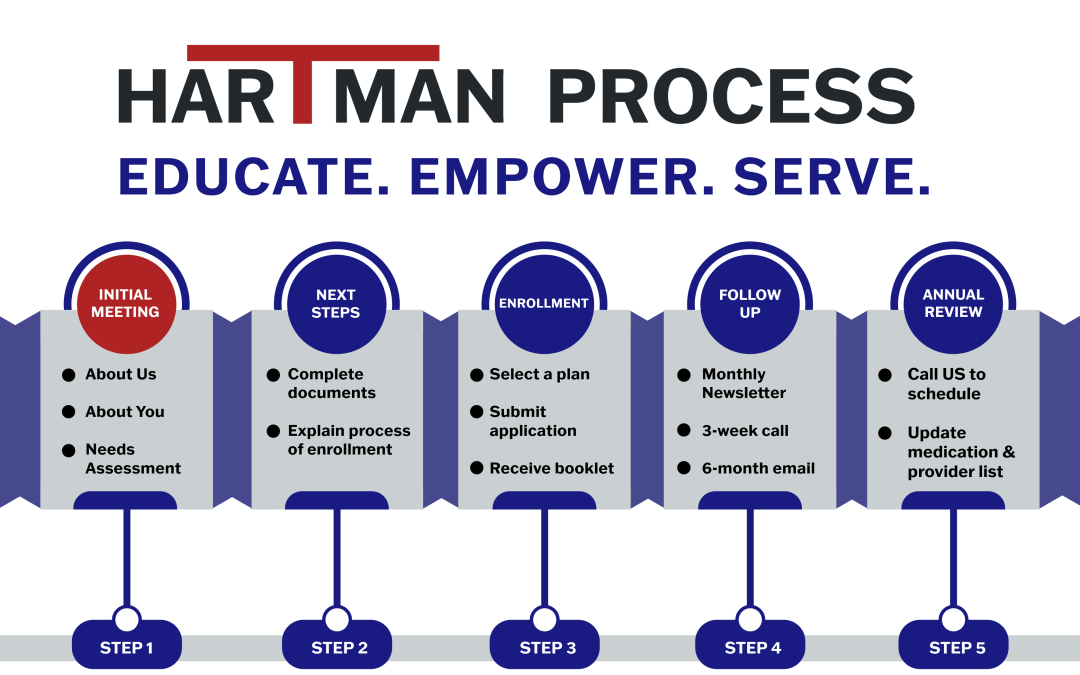

Understanding the Hartman Process

At Hartman Insurance Services our goal is to Educate, Empower, and Serve our community. We aim to empower you to make an informed decision regarding your health and life insurance needs. We can accomplish this by having a five-step process that each client will go through when they meet with one of our agents.

Step 1 Initial Meeting

We meet with you to learn more about you as an individual and you get to know who we are as an agency. We understand that everyone is unique, and we strive to find a plan that fits everyone’s unique needs. You will bring with you to your appointment our Appointment checklist, the Market Place Consent form (used for ACA clients) and/or the Scope of Appointment (used for Medicare clients).

Step 2 Next Steps

Sometimes additional documents are needed before you can enroll in a plan. We will provide instructions for you in our Hartman Insurance Services’ New Client folder that will explain the “Next Steps” you need to complete before you return to our office and enroll in a plan.

Step 3 Enrollment

After all additional documents have been completed, you are ready to enroll in a plan! We will review plan options and discuss any questions you may have. Once you have selected a plan, we will fill out and submit the application. You will leave with a booklet, brochure, or we will email you an electronic document about the plan you applied for.

Step 4 Follow Up

We email a newsletter around the 15th of every month to keep our clients informed of any changes that may affect you throughout the calendar year. A staff member from our office will call you three weeks after you enroll in a plan to check-in with you and verify that you received your new ID card in the mail from your new insurance provider.

Step 5 Annual Review

You will call US to schedule an appointment with one of our agents who will review your options for the upcoming year.

If you would like a FREE consultation with one of our agents, click here to contact us. Our office is always happy to help and to answer any questions you may have regarding health and life insurance.